The Average Discount Rate (%) serves as a critical key performance indicator (KPI) for understanding the balance between incentivizing purchases and maintaining profitability in an e-commerce landscape. In a market where discounts play a key role in attracting and retaining customers, it is essential for businesses to measure the average discount they offer.

By understanding the average discount rate (%), ecommerce businesses can decipher whether they’re giving away too much, potentially eating into their profit margins, or not offering enough to entice consumers.

Key Takeaways

- Definition: The Average Discount Rate (%) is a KPI indicating the mean discount percentage offered on orders over a specified period in ecommerce.

- Calculation: Average Discount Rate (%) is computed by dividing the Total Discount Amount by the Total Original Price and then multiplying by 100.

- Strategic Importance: This metric aids ecommerce businesses in balancing customer attraction through discounts and maintaining appropriate profit margins.

- Optimization Strategies: Ecommerce platforms can optimize their Average Discount Rate by employing segmented discounting, bundle offers, loyalty programs, and continuously reviewing profit margins.

- Limitations: While valuable, ADR doesn’t encompass all promotional impacts, can be distorted by short-term promotions, doesn’t differentiate between product categories, offers no insight into stock movement, is influenced by seasonal variations, isn’t directly tied to customer satisfaction, may erode brand value, may not be sustainable long-term, and lacks comprehensive context without additional metrics.

- Complementary Metrics: The Average Discount Rate should be considered alongside metrics like Gross Margin Percentage, Customer Acquisition Cost, Customer Retention Rate, and Average Order Value for comprehensive insights into business profitability and customer behavior.

Why does Average Discount Rate matter for your business?

The relevance of the Average Discount Rate (%) in ecommerce is multi-faceted:

- Customer Attraction: Discounts are a primary tool for attracting customers, especially first-time shoppers, and can enhance the conversion rate.

- Profit Margin Insights: A consistently high average discount rate might indicate that the business could be compromising on its profit margins, which could be detrimental in the long run.

- Promotional Strategy Evaluation: Monitoring this KPI aids in understanding the effectiveness of various promotional strategies, allowing businesses to refine and optimize their offers.

- Customer Retention: Regular discounts might be crucial for retaining certain customer segments, especially in highly competitive markets.

- Stock Management: Offering discounts can help in clearing out old inventory, making way for new products.

How to calculate Average Discount Rate (ADR)?

Explanation of the parts of the formula:

- Total Discount Amount signifies the combined sum of all discounts given across all orders. If a product originally priced at $100 is sold for $90, then the discount amount for that product is $10.

- Total Original Price is the aggregate value of all orders before any discounts are applied. It gives us a sense of what the total revenue would have been if no discounts were provided.

- The ratio of the Total Discount Amount to the Total Original Price offers insight into the average discount given as a proportion of the original price. This ratio produces a decimal value between 0 and 1 (or 0% to 100% when expressed as a percentage).

- Multiplying the previously calculated ratio by 100 converts the decimal value into a percentage, showcasing the average discount rate as a percentage of the original price.

In essence, the Average Discount Rate (%) serves as an indicator of the extent to which discounts are applied on average across all orders. A higher rate suggests that, on average, larger discounts are being provided, while a lower rate indicates the contrary.

Example Scenario

Let’s consider:

- The Total Original Price of all the products sold in a particular month was $10,000.

- Discounts totaling $1,500 were given during the same period.

Plugging these numbers into the formula, we get:

- Average Discount Rate (%) = ($1,500 / $10,000) × 100

- Average Discount Rate (%) = 0.15 × 100

- Average Discount Rate (%) = 15%.

This indicates that, on average, a discount of 15% was applied to products sold on the website during this month.

Tips and recommendations for balancing Average Discount Rate

To ensure a healthy balance between customer incentives and profit margins:

Set Clear Promotional Objectives

Setting clear objectives for each promotion is critical to maintaining a balanced average discount rate. If the goal is customer acquisition, the discount strategy could be more aggressive to attract new customers. On the other hand, if the goal is to clear inventory, the discounts on certain products might be higher to make room for new inventory. For customer retention, you might prefer to offer special offers or exclusive discounts to returning customers. By clearly identifying the purpose of each campaign, you can tailor your discount strategies accordingly and maintain a more balanced average discount rate.

Segmented Discount Strategies

A segmented approach to discounting can help balance your average discount rate. Instead of offering blanket discounts to all customers, consider segmenting your customer base and offering targeted discounts. For example, first-time customers could receive a higher discount to encourage first-time purchases, while returning customers could receive a lower but ongoing discount to encourage loyalty and repeat business. This approach allows you to control the average discount rate more effectively because you’re not offering deep discounts to everyone.

Bundle Discounts

Bundling products and offering discounts on those bundles can also help balance your average discount rate. Instead of discounting individual items, which can lead to a high overall discount rate, consider bundling related products together and offering a discount on the bundle. This strategy can often result in higher sales volume and better inventory turns while keeping the average discount rate in check.

Loyalty Programs

Implementing loyalty programs is another effective way to maintain a balanced average discount rate. Rather than relying solely on discounts, loyalty programs allow customers to earn points or rewards for their purchases, which can eventually be redeemed for discounts or free products. This strategy encourages repeat purchases and customer loyalty without the need to constantly offer deep discounts, helping to keep your average discount rate balanced.

Regularly Review Profit Margins

To ensure that your business remains profitable despite offering discounts, it’s important to regularly review your profit margins. This requires monitoring not only the impact of discounts on sales, but also their impact on profitability. If your average discount rate is too high, it could be eating into your profit margins. Regular reviews will allow you to adjust your discount strategies as necessary and ensure a healthy balance between driving sales through discounting and maintaining profitability.

The Shoptimizer theme allows you to add a site wide banner with a discount, as well as many other options for offering discounts.

Examples of use

Inventory Clearance

- Scenario: An ecommerce platform selling electronics finds a surplus of a particular model of headphones.

- Use Case Application: The platform offers a 20% discount on the headphones to clear out inventory, increasing sales. Monitoring the average discount rate helps them ensure profitability on other products, balancing out the discounted sales.

Customer Acquisition Drive

- Scenario: A new ecommerce fashion store aims to attract more first-time buyers.

- Use Case Application: The store provides a 15% discount on the first purchase. The store’s average discount rate spikes initially but is used as a metric to monitor and eventually bring down as the store gains more traction and returning customers.

Volume Purchase Incentive

- Scenario: A B2B supplier of office furniture is looking to encourage bulk purchases from corporate clients.

- Use Case Application: The supplier offers a tiered discount structure, where companies buying more than 50 items get a 10% discount, those buying more than 100 items get a 15% discount, and so on. By monitoring the average discount rate, the supplier can determine the success of the incentive and also ensure that the discounts are not eroding their profit margins substantially.

Loyalty Program

- Scenario: A coffee shop chain wants to reward its frequent customers.

- Use Case Application: Customers receive a 5% discount on their 10th purchase, and a 10% discount on their 20th purchase. By looking at the average discount rate, the coffee shop can gauge the effectiveness of their loyalty program in terms of repeat business, while also ensuring their overall profitability remains intact.

End-of-Season Sale

- Scenario: A sporting goods store needs to clear out last season’s merchandise to make room for new stock.

- Use Case Application: The store offers a 30% discount on all items from the previous season. By monitoring the average discount rate, the store can analyze how much of their sales are coming from discounted merchandise and how it’s impacting their overall profit margin.

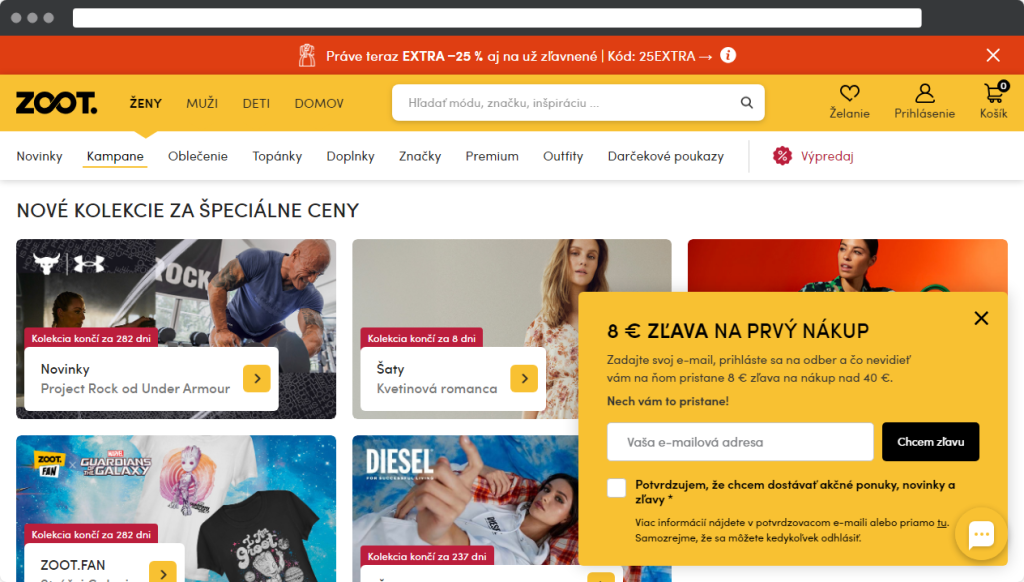

Clothing retailer Zoot uses a variety of discount options on its website, including site-wide banners, a newsletter discount for new customers, and even easy-to-apply discount campaigns.

Average Discount Rate SMART goal example

Specific – Decrease the Average Discount Rate given on products by 15% (from a current rate of 25% to 10%).

Measurable – The average discount rate will be monitored and compared on a weekly basis using the eCommerce analytics platform before and after revising the pricing and discount strategy.

Achievable – Yes, by revising our promotional strategies, optimizing the pricing model, limiting discount days, and introducing loyalty programs that give non-monetary benefits (like early access or exclusive products) instead of heavy discounts.

Relevant – Yes. Reducing the average discount rate is essential for improving profit margins and maintaining a premium brand image. It’s in line with the quarterly goal to enhance profitability without sacrificing sales volume.

Timed – Within three months of introducing the new discount strategy.

Limitations of using Average Discount Rate

Average Discount Rate (ADR) is an essential metric for understanding the depth of discounting in an ecommerce environment. However, it too has its own limitations when used in business analysis:

- Doesn’t Capture Full Promotional Impact: ADR measures the average discount given, but it doesn’t capture the full scope of promotional activities like bundle offers, loyalty points, or free shipping, which might also influence purchasing decisions.

- Can Be Influenced by Short-term Promotions: Flash sales or temporary high discount rates can skew the ADR for a specific period. This might give a false perception that the business is always heavily discounting when it might just be a one-time event.

- Doesn’t Differentiate Between Product Categories: A high discount on a less popular product and a small discount on a bestseller will affect the ADR, but their impact on revenue and profitability will be vastly different. ADR doesn’t provide that nuance.

- Doesn’t Indicate Stock Movement: A higher ADR might indicate that items are being sold at a significant discount, but it doesn’t show if these discounts are effectively moving slow-selling stock.

- Subject to Seasonal Variations: Similar to AOV, ADR can also vary during sales, clearance events, or holiday periods. It’s essential to differentiate between regular discounts and seasonal ones.

- Not Directly Tied to Customer Satisfaction: A high ADR might attract more sales, but if the discounted products are of low quality or don’t meet customer expectations, it can lead to returns and negatively impact customer satisfaction.

- Potential for Eroding Brand Value: A consistently high ADR might make customers perceive the brand as ‘cheap’ or of lower value, especially if competitors aren’t discounting as heavily.

- May Not Be Sustainable in the Long Run: While discounts can boost short-term sales, relying heavily on them can hurt profitability. A business should ensure that its pricing strategy is sustainable.

- Lacks Context Without Additional Metrics: A high ADR might seem like the business is discounting too much, but if the overall profitability, conversion rate, and customer retention are positive, then the discount strategy might be working.

In summary, ADR provides insight into the discount strategy of an e-commerce business. However, it should be used judiciously and in conjunction with other relevant metrics to ensure a holistic understanding of business performance. Relying on ADR alone can lead to misinformed decisions.

KPIs and metrics relevant to Average Discount Rate

- Gross Margin Percentage: This shows the profit margin after deducting the cost of goods sold, giving insights into profitability post discounts.

- Customer Acquisition Cost: A high average discount rate combined with a high customer acquisition cost could indicate unsustainable marketing strategies.

- Customer Retention Rate: If the business relies heavily on discounts, monitoring the customer retention rate ensures that customers are returning and not just bargain hunting.

- Average Order Value (AOV): This provides insights into how much customers are spending per order, especially after discounts.

A holistic approach to discounts involves understanding and optimizing the average discount rate alongside these metrics to ensure both customer satisfaction and business profitability.

Final thoughts

The Average Discount Rate (%) acts as a beacon, guiding ecommerce businesses on their journey to attract customers while maintaining profitability. In the competitive world of online shopping, while discounts can be the lure, it’s imperative to ensure they don’t become a profitability trap. Regular monitoring and tactful management of this KPI will ensure a sustainable and thriving ecommerce business.

Useful links

Average Discount Rate (ADR) FAQ

What is Average Discount Rate (%)?

It is the mean discount percentage provided on orders over a specified period.

Why is Average Discount Rate (%) essential for my ecommerce business?

This metric helps maintain a balance between attracting customers with discounts and ensuring appropriate profit margins.

How can I optimize my Average Discount Rate (%)?

Consider segmented discounting, bundle discounts, and loyalty programs, and always ensure to review profit margins regularly.

Does a higher Average Discount Rate (%) mean lower profits?

Not necessarily. It depends on volume, other operational costs, and the overall pricing strategy. However, consistently high rates without corresponding volume might impact profitability.

What if my Average Discount Rate (%) is too low?

A very low rate might indicate that you’re not providing enough incentives for customers, potentially affecting sales. It’s crucial to find a balance that works best for your business and customer base.